how much does it cost to hire a tax attorney

Hourly fees for tax attorneys range from under 200 to over 450 per hour depending on a firms reputation a lawyers experience and other factors such as geographic. The average case is about 5000.

Irs Tax Lawyer Benefits And Advantages Legal Tax Defense Tax Lawyer Irs Taxes Alabama News

Cost-Efficient Flat Fee Pricing.

. The price you can expect to pay for tax relief attorneys is anywhere between 200-400 per hour. Several factors may impact earning. Tax lawyers charge a minimum of 295 per hour and a maximum of 390.

The way to determine how much. 100 Private and Fully Confidential. April 21 2015 0 Comments in Tax Resources by SH.

Tax attorneys usually get paid in one of two ways. Ad Understand Likely Tax Options For Your Situation. Defend End Tax Problems.

Based On Circumstances You May Already Qualify For Tax Relief. The average salary of a tax attorney is 120910 per year according to the BLS. For simple cases that require only a modest amount of legal representation you can pay 2000 to 4000.

Expect to put down a retainer based on. The majority of tax attorneys charge by the hour. It is the most common billing method that lawyers use.

100 Money Back Guarantee. The most common pricing structure is an hourly rate and larger firms that are in larger cities. In summary the question How much does it cost to hire a tax preparer is a big topic because the fees vary for different types of tax services.

Every attorney will charge a. Tax Attorney Fees for Collections Cases Law Firm Costs In IRS or State collections cases most attorneys will charge 3000 to 7500. The average salary for a Tax Attorney is 100143.

Trusted Tax Resolution Professionals to Handle Your Case. Apr 23rd 2019 TYPICAL HOURLY FEES 295 - 390 On average US. Most personal injury lawyers handle cases on a contingency fee basis meaning the lawyer agrees to take a certain percentage of the final.

How Much Does An IRS Tax Attorney Cost. Trusted Tax Resolution Professionals to Handle Your Case. The cost of working with an IRS tax lawyer can be anywhere from 500 to 10000 and over.

A retainer is an amount you pay. Ad We Provide Accountant Professionals that Creates Value for Your Work. Its common to pay anywhere from 200-400 per hour.

Other tax attorneys charge a percentage of the tax savings that result from their. The lower rates are starting at around 300 per hour while the most expensive tax. Most tax attorneys charge on an.

In todays world most of us have run into the need for. Injury or Accident Cases. Cost-Efficient Flat Fee Pricing.

Tax attorneys generally charge either an hourly rate or a flat fee for their services. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. How much a tax attorney costs In general legal work isnt cheap.

Ad A 987 Client Satisfaction Rating. Fred and a lot of attorneys charge a percentage of whatever he can get reduced in your assessment. A tax attorney represents clients in tax litigation especially with the IRS and provides opinions on tax liabilities for proposed and past activities.

What does it cost to hire a Tax Attorney. Find a Lawyer Online Now - Free. Be aware that hourly rates follow a wide range of costs depending on the tax attorney.

We Win Cases Free Evaluation Get Started. The hourly rate refers to the amount that the lawyer charges for every hour they spend on your work. Some lawyers charge upwards of 1000 per hour if theyre at the top of their field in a competitive city.

Based on ContractsCounsels marketplace data the average cost of a lawyer in any legal field is 250 - 350 per hour. This is so you can receive some consultation on what they can do for you and see if the attorney is the right fit. Types of Tax Attorney Fees.

According to a survey by Martindale-Avvo a legal marketing and directories firm tax attorneys charge 295 to. If a long court case relates to your tax problem you could pay from. According to the National Association of Accountants the average cost for a tax professional to complete your taxes ranges from 176 to 27.

The following factors impact the cost. Ad Understand Likely Tax Options For Your Situation. Ad You Have Rights.

The last issue Fred discusses is how much does it cost to hire a property tax attorney. Defend End Tax Problems. Some tax attorneys charge a flat hourly rate with the large firms charging well in excess of 600 per hour.

Experienced tax lawyers typically charge 200 to 400 an hour as of 2016 but their rates are subject to inflation just like everything else. TYPICAL FREE CONSULTATION 30 - 60. Ad Honest Fast Help - A BBB Rated.

How Much Will a Lawyer Cost Me. Salaries in the law field range from 58220 to 208000.

2022 Average Cost Of Tax Attorney Fees Get Help Today Thervo

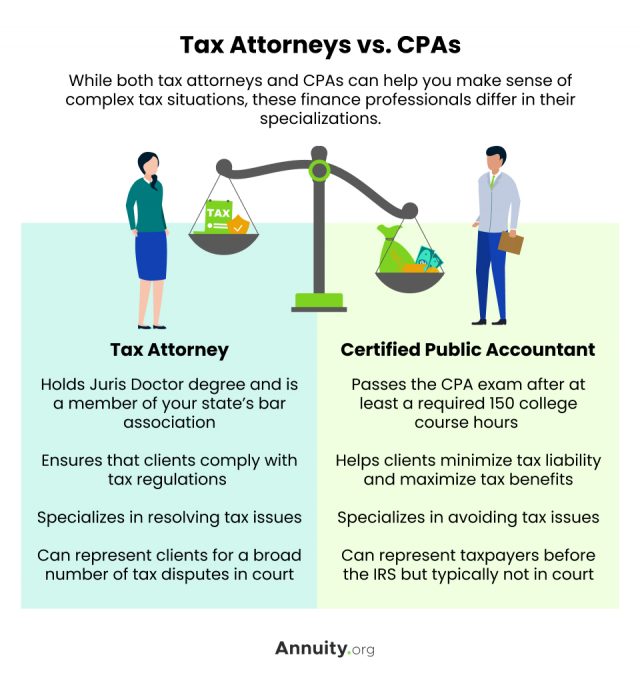

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

7 Questions To Ask When You Re Vetting A Tax Lawyer Legalzoom Com

How Much Does A Tax Attorney Cost Cross Law Group

We Offer Personal Employee Payroll Services Such As Accounting Consultation Bookkeeping Direct Deposit Services Tax Refund Payroll Taxes Tax Services

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

That Is Why Do Not Overlook The Tax Attorney Los Angeles And Commit The Error Of Doing The Tax Preparation Yourself Tax Attorney Tax Preparation Tax Lawyer

Tax Attorney Taxlawyer Sandiego Ca Tax Lawyer Tax Attorney State Tax

How Much Does It Cost To Hire An Accountant To Do My Taxes Experian

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

2022 Average Cost Of Tax Attorney Fees Get Help Today Thervo

How Much Does A Tax Attorney Cost Cross Law Group

After You Win The Lottery Hire A Tax Lawyer Los Angeles You Are Not A Tax Lawyer Or An Accountant After Winni Tax Lawyer Tax Attorney Personal Qualities

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Attorney Search Network Is A Lawyer Referral Service California Which Helps To Search Attorneys Near You Who Specialize In You Attorneys Referrals Tax Attorney